Are You 55 Years Old or Older?

Let Us Explain How To Get 100% Tax-Free Long-Term Care Benefits From A Life Insurance Policy -- Taking Advantage of the 1035 Exchange Rules

CONSUMER INFORMATION: 1035 Exchanges Life Insurance Policies

Time changes everything. The intended use of your life insurance policy may have changed. Maybe it's time to exchange your coverage for a life insurance policy THAT ALSO PROVIDES LONG-TERM CARE BENEFITS.

Congress passed laws designed to encourage more Americans to plan for the very real risk of one day needing costly long-term care.

Congress passed laws designed to encourage more Americans to plan for the very real risk of one day needing costly long-term care.

The Pension Protection Act (PPA) allows for leverage (which simply means more value should you need LTC) and tax benefits for qualifying Life + LTC policies.

One of consumers' main concerns about long-term care (insurance) planning is that they will pay premiums but may never receive benefits. Exchanging an existing life insurance policy for a Life+LTC policy can resolve this concern.

How To Repurpose an Existing Life Insurance Policy

The IRS lets you exchange an existing life insurance policy for a new one that includes LTC benefits. We refer to these policies as Life + LTC policies.

There are a number of reasons to consider exchanging an existing life insurance policy:

Changing Needs

An attractive LTC Planning Option

Better Coverage and Tax Advantages

A Stronger Insurance Company

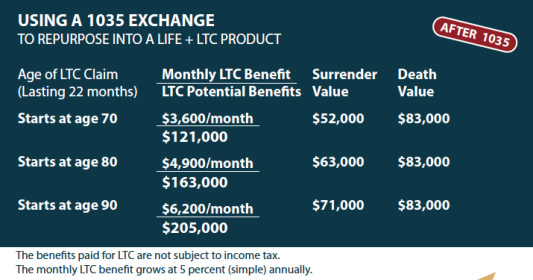

REAL EXAMPLE #1 - MALE AGE 60 - CASH VALUE LIFE POLICY WORTH $75,000 - THE DEATH BENEFIT NO LONGER OF VALUE

CHIEF CONCERN NOW IS BURDENING HIS FAMILY WITH POTENTIAL LONG-TERM CARE COSTS

He repurposes (exchanges) his current life policy into a Life+LTC product. The chart below shows how he retains a DEATH BENEFIT and SURRENDER VALUE benefit. Plus, it shows the Monthly Long-Term Care Benefit he could receive ... and the Total Potential LTC Benefits available tax free if he needed long-term care.

We can connect you with a professional experienced in 1035 Exchanges.

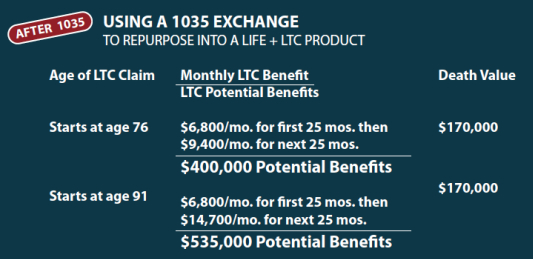

REAL EXAMPLE #2 - WOMAN AGE 66 HAS CASH VALUE LIFE INSURANCE POLICY THAT IS WORTH $150,000.

SHE WANTS TO LEVERAGE POLICY TO MAXIMIZE TAX-FREE LTC BENEFITS

She repurposes (1035 Exchanges) the current policy for a Life+LTC policy. The image below shows the Monthly LTC Benefit she could receive as well as the potential benefit pool of dollars available to her.

If she starts needing long-term care at age 91, her policy will provide $6,800 for the first 25 months. Then, it will pay $14,700 for the next 25 months. THAT'S $535,000 of total potential benefits. And, if she dies without needing LTC, the policy still pays a death benefit of $170,000 to her designated beneficiaries.

We can connect you with a professional experienced in 1035 Exchanges.

The American Association for Long-Term Care Insurance and the Association's 1035 consumer guide and all information on these pages is provided for overview and informational purposes only and is not intended as tax, legal, fiduciary or investment advice.

We encourage you to learn more about the significant tax advantages available when you 1035 exchange a current annuity. You can call the Association's offices or complete the Request A Quote form. Click here to access the Request a 1035 Exchange Quote.

Examples shown are real based on available products from leading Linked Benefit LTC insurance companies (December 2017) but products and benefits will vary from one company to the next and can even vary by state.

back to top

24 Pages of Info

No Sign-In To Access

Click the Image to Access

Click the Image to Access

Have an Annuity?

Learn about 1035 Exchanges for Annuities

Click Here For Information