Are You 50 Years Old or Older ... And Haven't Done Any Long-Term Care Planning ?

Let Us Explain How To "Repurpose" Your Existing Annuity ... Keeping Your "Just In Case" Money ... PLUS Getting 100% Tax-Free Long-Term Care Benefits

CONSUMER GUIDE: 1035 Exchanges for Annuities

Millions of Americans like you include fixed or indexed annuities in their retirement strategy. Many consider them "just in case" dollars that can be used if needed during retirement - say for long-term care expenses.

If you need long-term care, you can take woithdrawals from your annuity to cover expenses. But, there will be tax implications. THE RESULT: you'll likely be paying taxes at a time when you'll need the money more than ever.

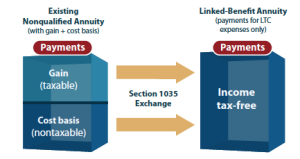

When you withdraw money from a (non-qualified) annuity, the portion of the annuity that is the gain will be subject to taxation.

When you withdraw money from a (non-qualified) annuity, the portion of the annuity that is the gain will be subject to taxation.

But Congress passed the Pension Protection Act (PPA) which now enables individuals to exchange one annuity for another annuity. The new annuity will continue to grow your assets. BUT IT ALSO can provide 100 percent income tax-free payments for long-term care.

A 1035-Exchange into a new qualifying annuity can offer you significant tax advantages.

These exchanges (from an existing annuity to one that meets the Congressional requirements) are referred to as "Section 1035 Exchanges". Section 1035 is the Internal Revenue Code (the IRS rulebook).

The Pension Protection Act (PPA) became law in 2010 and today there are PPA "linked benefit annuity" options. They are called linked benefit because they act just like an annuity - growing in value. BUT THEY ALSO PROVIDE THE POTENTIAL FOR LONG-TERM CARE BENEFIT PAYTMENTS offering some significant tax-advantages when monies are withdrawn.

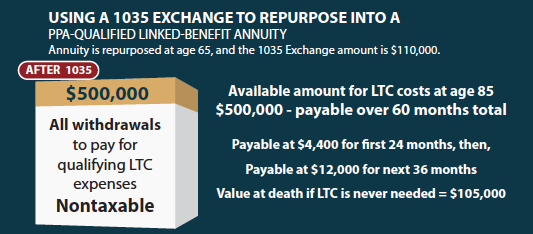

REAL EXAMPLE #1 - CURRENTLY AGE 65 - COST BASIS $75,000 -

WANTS FUNDS IN CASE THEY FACE LONG-TERM CARE EXPENSES

An individual who is now age 65 owns a nonqualified annuity that he or she obtained at age 49 (cost basis = $75,000). The annuity is now worth about $110,000 and is projected to be worth $180,000 when they reach age 85. He or she have other retirement savings but the annuity could be used if they faced long-term care expenses.

IF THEY DO NOTHING- taking withdrawals from the annuity to pay for long-term care means that $105,000 (the GAIN over the $75,000 Cost Basis) WILL BE TAXABLE

IF THEY DO A 1035 EXCHANGE to a Linked-Bennefit Annuity here's how they could benefit.

At age 65 they 1035 Exchange the current $110,000 annuity to a Linked-Benefit Annuity

that will continue to grow.

IF THEY NEEDED LONG-TERM CARE AT AGE 85 - the new annuity could offer

$500,000 payable over 60 months total.

ALL WITHDRAWALS to pay for qualifyiing LTC expenses would be NONTAXABLE.

IF THEY NEVER NEEDED LTC - the annuity value at death would be $105,000.

We can connect you with a professional experienced in 1035 Exchanges.

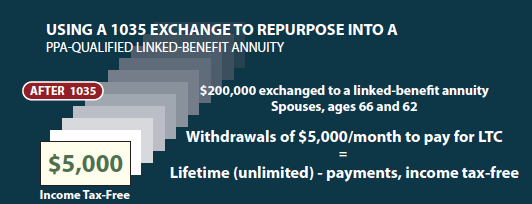

REAL EXAMPLE #2 - COUPLE AGES 62 & 66 - $200,000 IN AN ANNUITY -

THEY CAN GET LIFETIME LONG-TERM CARE PAYMENTS INCOME TAX FREE

In this situation one spouse has an annuity that is currently worth $200,000. They haven't done any long-term care planning - but they'd like to. But they don't like the "use it - or lose it" nature of health based traditional long-term care insurance."

IF THEY DO NOTHING- their annuity will continue to grow. If they take withdrawals to pay for long-term care a portion WILL BE TAXABLE

IF THEY DO A 1035 EXCHANGE to a Linked-Bennefit Annuity here's how they could benefit.

The current $200,000 annuity in a Linked-Benefit Annuity will continue to grow.

IF THEY NEEDED LONG-TERM CARE - the new annuity provies $5,000 monthly withdrawals to pay for qualifying LTC expenses.

Benefits could continue UNLIMITED (lifetime) for EITHER or BOTH spouses!

ALL WITHDRAWALS to pay for qualifyiing LTC expenses would be NONTAXABLE.

IF THEY NEVER NEEDED LTC - and the second spouse dies at 94 - the annuity pays the designated beneficiaries $202,000.

We can connect you with a professional experienced in 1035 Exchanges.

The American Association for Long-Term Care Insurance and the Association's 1035 consumer guide and all information on these pages is provided for overview and informational purposes only and is not intended as tax, legal, fiduciary or investment advice.

We encourage you to learn more about the significant tax advantages available when you 1035 exchange a current annuity. You can call the Association's offices or complete the Request A Quote form. Click here to access the Request a 1035 Exchange Quote.

Examples shown are real based on available products from leading Linked Benefit LTC insurance companies (December 2017) but products and benefits will vary from one company to the next and can even vary by state.

back to top

24 Pages of Info

No Sign-In To Access

Click the Image to Access

Click the Image to Access

Have a Cash Value Life Insurance Policy?

Learn about 1035 Exchanges for Life Insurance

Click Here For Information