Linked Benefit Warning - What You Need To Know Before Buying

IMPORTANT DISCLAIMER:

The following information is provided as a general overview of the topic. Insurance policies are contracts. They can vary significantly and their language will govern if and when you will qualify for benefits and how they are calculated. The Association does NOT give any legal or financial advice.

IMPORTANT DISCLAIMER:

The following information is provided as a general overview of the topic. Insurance policies are contracts. They can vary significantly and their language will govern if and when you will qualify for benefits and how they are calculated. The Association does NOT give any legal or financial advice.

Consumers should request a “Specimen Policy” and read it carefully before buying. Your financial advisor or agent can provide one for you.

A “Specimen Policy” is NOT an “Outline of Coverage” which is merely an "illustration" of benefits. The policy contains the specific definitions.

Why Use An Alarming Word Like "WARNING"?

If some people feel that ‘Warning’ is an alarmist word, well it is. It’s hard enough to get people to plan for long-term care.

Buying something that may not fulfill your future expectations goes against what the Association stands for. And that can indeed happen. Only you won't know it UNTIL you finally need care which will be years from now.

We support and encourage all forms of planning and the many quality insurance solutions and agents / advisors out there.

Our belief is that an educated consumer is the best customer. With that in mind, we hope you find this information of value.

When Is A Long-Term Care Insurance Policy NOT A LTC Insurance Policy?

We use the easy-to-understand term "linked benefit". But really (and legally) there are "Linked Benefit", "Combo", "Chronic Illness", "Discounted Chronic Illness", "7702B" and "101(g)" plans. They all could be considered "linked benefit" (except by lawyers). CONFUSED? You bet!

According to the latest industry data there were just over 225,000 (total) of these products purchased in 2021.

The vast majority - ALMOST 150,000 are 'Chronic Illness Riders' - NOT 7702B long-term care riders.

Why does it matter?

But wait (you say). The brochure reads and sounds just like a long-term care insurance brochure. That's True!

But wait (you say). The brochure reads and sounds just like a long-term care insurance brochure. That's True!

The brochure doesn't matter. ONLY THE POLICY LANGUAGE MATTERS!

And you don't get a policy (contract) until AFTER YOU BUY.Which is why we recommend requesting a "Specimen Policy" before you buy. It will likely be 50 pages of single-spaced legalese. That contract will govern everything that matters to you when you are ready to benefit from what you bought.

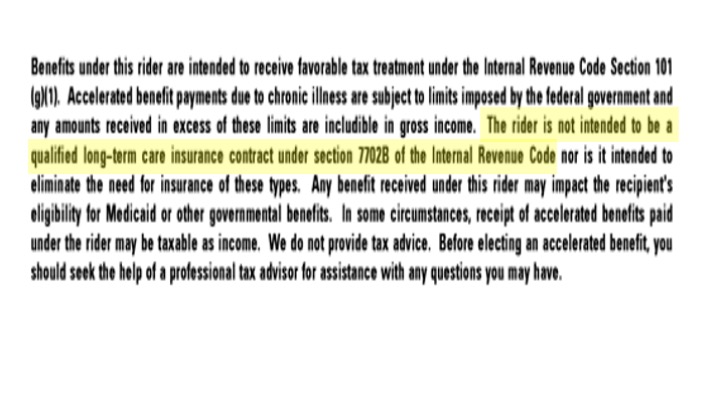

And a policy following 101(g) regulations is supposed to contain the words "This is not intended to be a qualified long-term care insurance contract"

That's what you want to watch for. If you want 'long-term care insurance', why would you buy something that specifically says it' s not intended to be long-term care insurance?

IRC Section 7702B versus 101(g)

We are not going to bore you (or overload you) with technical details. There are many. Many!

Here are the main ones we want to focus on.

The Internal Revenue Code (IRC) 7702B sets forth the rules applying to long-term care coverage. Insurance agents must undergo specific training (and continuing education) to market and sell these products. There are some very important consumer protections that protect you.

IRC Section 101(g) specifically says that 101(g) policies may NOT be marketed in any manner as long-term care coverage. You won’t find the words ‘long-term care’ in any of the material. You may see nursing home care, assisted living, home care BUT NOT the words long-term care.

With 101(g) plans insurance agents have NO continuing education requirements.

Plans are NOT subject to suitability or consumer protections found in 7702B plans.

The insurance company may ‘control’ how payouts are calculated come claim time.

This has the potential to be really big. PAYOUTS are WHY you buy this policy!

Before you go rushing to complete the Request A Quote Form, let’s explain that not all 101(g) plans are alike. Some insurers have more protections and claim benefits. But, you’ll likely not know who does and how they work without really doing a lot of investigating.

Look for this stated (somewhere) in the policy.

Look for this stated (somewhere) in the policy.

101(g) Claims That May Not Qualify

As we said, 101(g) policies look, feel, smell and taste like long-term care insurance. They will use lots of words that sound so familiar – like skilled nursing home, and home care benefit.

But here are a few examples of 101(g) claims that likely won’t qualify for benefits. They were shared by knowledgeable long-term care insurance specialists.

Complications Following Orthopedic Repair Surgery. Every year 1 million knee and hip replacements are performed in the U.S. Most go well. People recover pretty fast and never need care for more than a short period of time. But, not all. If you need lengthier rehab (even a nursing home stay) for say 6 months, a chronic illness rider - 101(g) plan would never pay. A 7702B plan would.

Recoverable Stroke. Every year some 800,000 Americans have a stroke. The vast majority are older, over age 60. The good news is that many recover. But recovery can take time. Say you needed 4 months in a skilled nursing home followed by 6 months of care in your own home. None would be covered under a 101(g) plan. A 7702B would.

Side Effects of Cancer. Cancer strikes many people in their 50s and 60s. Breast cancer for women; prostate cancer for men. Typically, treatments don’t incapacitate you. But they could. You could find yourself needing care for months and unless you were diagnosed as terminal (expected to die) a 101(g) plan would not be of benefit. Though you consider yourself as needing long-term care. Again, a 7702B plan likely would provide benefit.

Will 101(g) Plans COVER ANYTHING MORE than a 7702B?

We're telling why 7702B plans can be better than 101(g). Is there anything a 101(g) plan will cover that a 7702B does NOT?

A 101(g) policy will not cover anything more than a 7702B cash indemnity policy would. But comparing 101(g) to reimbursement policies, it could. That's because 101(g) is a cash benefit.

BUYER'S TIP! Look for a 7702B cash indemnity long-term care policy. That gives you the same spending flexibility you get with a 101(g) policy. AND it provides important policy protections you won’t get with a 101(g) policy.

How To Find Out Which Is A 101(g) Plan

Before you buy any policy, ask your financial advisor or insurance agent to send you a “Specimen Policy”.

IMPORTANT: A Specimen Policy is not an Outline of Coverage which shows an illustration of your policy benefits. It is the actual policy contract.

NOTE: If the advisor or agent object to sending you a Specimen Policy -- find another agent.

You are not going to read the policy. Though you should feel free to. You are simply going to look for the IRC Code. Every policy will spell it out differently. There are no specific rules as to where it must appear (wouldn’t that be a nice provision).

What Is A Chronic Illness Policy?

When is a “Linked Benefit Long-Term Care” policy NOT a true linked-benefit policy?

The answer is when it is a “Chronic Illness” rider. Confused? You should be. But rest assured the insurance company understand the difference.

Come claim time, this type of policy may not provide the benefits you expected.

How can you tell the difference? A chronic illness policy (sometimes referred to as 101(g) plans, must specifically say (somewhere in the 50-plus page contract) that this “is not intended to be long-term care insurance”. That’s why we specifically urge you to request a “Specimen Policy” before buying.

An added note. Don’t confuse “Chronic Illness” with “Critical Illness” policies. The latter pays a lump sum if you are diagnosed with specific conditions like cancer, heart attack or stroke.

But that’s the simplified explanation. Because combines - or links - LTC insurance benefits with another type of insurance like life insurance or an annuity. It provides a pool of money to pay for long-term care expenses, but if you never need care your heirs receive a life insurance death benefit or the cash value from an annuity.

Linked-Benefit Agents Can Help You Compare

Thank you for taking the time to read this important summary.

If you’d like to speak with ONE linked-benefit long-term care agent, take a second to complete the Association’s Request A Quote Form.

Your information will be shared with just ONE specialist. Or, if you prefer, call the Association’s offices at 818-597-3227.

Learn more: Find the best linked-benefit long-term care insurance now.