Are Hybrid Policies Tax Deductible?

Tax Opportunities for Business Owners.

Hybrid or linked-benefit long-term care insurance policies generally do NOT qualify for a premium tax deduction.

Hybrid or linked-benefit long-term care insurance policies generally do NOT qualify for a premium tax deduction.

However, a few insurers do meet the "tax qualified" standards and part of the hybrid long-term care premium may be deductible. Business owners can take advantage of special policy designs that enable a significant amount of the premium to be deducted.

"Hybrid" or "linked-benefit" long-term care policies are increasingly popular. They combine a life insurance policy or an annuity with a long-term care rider. These policies provide money for qualifying long-term care if you need it. If you don't need care, they pay a death or annuity benefit to a designated beneficary.

Today, there are many insurers who now market these policies. They can differ in terms of cost (price), potential future benefits and tax deductibility. A tax-smart LTC agent can really help a business owner maximize their tax deductions,

This webpage shares a tax-advantaged strategy specifically for business owners. Information presented here is for general information only and should not be used nor relied upon as specific tax advice. Individuals should consult with their CPA or qualified tax professional for advice regarding their own tax situation and the tax status of LTC premiums and benefits.

Hybrid Tax Deductible Information For Business Owners

Tax deductions help make the policy more affordable and more desirable of a purchase.

Business owners are afforded more liberal LTC tax advantages than individual taxpayers;

C-Corporations get 100% deduction of LTC premiums,

Owners of pass-through entities avoid the 7½ % floor requirement - ensuring they get their LTC tax deduction (subject to age-based limits)

TIPS: Here are the most important things to know about hybrid long-term care insurance.

Costs can vary among different policies.

Future benefit levels can also vary significantly.

Only a few policies are structured to allow limited tax deductibility.

The right policy design can yield some greater tax advantages.

Best plan designs should vary based on your age when applying.

TIP: You generally only buy hybrid LTC once. It rarely pays to switch coverage. The diffrerences outlined above are a few reasons to compare before signing on the dotted line.

If you are interested in comparing hybrid policies, the Association strongly recommends speaking to a hybrid long-term care specialist.

Call us at 818-597-3227 or complete the Compare Benefits form and submit.

Maximize The Tax Deductibility Of A Hybrid LTC Policy

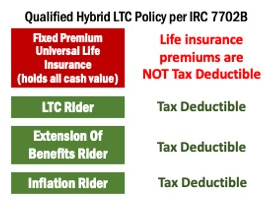

First, you want a policy that meets Internal Revenue Code (IRC) Section 7702B. Not all hybrids meet IRC 7702. Many today are IRC 101(g) plans.

First, you want a policy that meets Internal Revenue Code (IRC) Section 7702B. Not all hybrids meet IRC 7702. Many today are IRC 101(g) plans.

Next, to maximize the tax deductiblilty benefits you want a hybrid policy with separate policy "components" with separately identifiable premiums.

You pay ONE premium. But the insurer "separates" them as a separate identifiable premium.

The portion of the premium paid for the life insurance benefit is NOT DEDUCTIBLE.

The LTC riders CAN BE DEDUCTIBLE.

The optional Inflation Benefits Rider provides the real opportunity TO MAXIMIZE THE TAX DEDUCTIBLKE PORTION. This is where working with an experienced hybrid long-term care insurance specialist can really benefit you.

A Real Example: Hybrid LTC Policy Maximum Tax Benefits

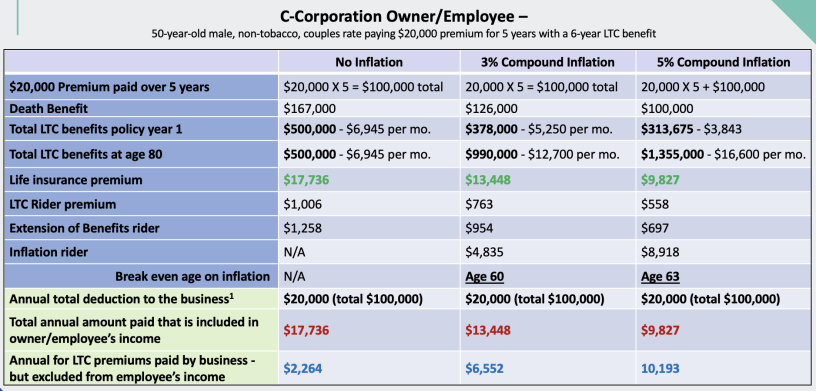

Let's give a real example (posted May 2022) of how a business owner at age 50 could maximize the tax deductible benefits by selecting the right hybrid policy and the right policy plan design.

In the illustration below, a C-Corporation is buying linked benefit policies for the owner who is also an employee, as well as a few select executives. By designing the policy to include the optional inflation rider, there are more LTC benefits at age 80. And, there is less taxable income created by each of the 5 annual premiums. This is due to the shift in balance between death benefit and LTC benefits.

TIPS: Adding inflation reverses the premium exposure from life insurance to long-term care.

Reducing the life insurance premium reduces the taxable compensation

Make sure to ask about and consider the “break even” age for older applicants

C-Corporation Business Owners Get Maximum Tax Benefits

C-Corp owners can use retained corporate earnings in a tax efficient manner to purchase LTC coverage for the owner(s) /employee and select non-owner employees.

TIP TO MAXIMIZE THE BUSINESS DEDUCTION: C-corporation owners and non-owner/employees may be able to utilize shorter premium payment schedules (example, pay off the full cost of the policy in 5 years.). However, tax advisors we spoke to suggest that the business will want to take care that the life insurance premium is “reasonable and necessary” in amount.

Questions To Ask Before Buying

Which Internal Revenue Code Applies To The Policy You Are Recommending? Is it 7702B or 101(g). IF the financial advisor is not sure, consider finding one who understands the difference.

How Many Hybrid Long-Term Care Insurance Companies Are You 'Appointed' With? Appointed means the agent or financial advisor can earn a commission by selling you the particular plan. Chances are they will NOT compare plans they can NOT earn a commission selling.

Will You Compare A Hybrid LTC Plan With A Traditional LTC Policy? Hybrid policies cost 2-to-4 times more than a traditional long-term care insurance policy. That's because they offer dual benefits (long-term care AND a life insuramnce death benefit). Comparing at least allows YOU to make the decision of what's best for you.

More Hybrid LTC Resources

Speak with a hybrid long-term care agent who specializes in long-term care insurance.

See the latest long-term care insurance statistics including price comparisons for traditional and hybrid LTC.