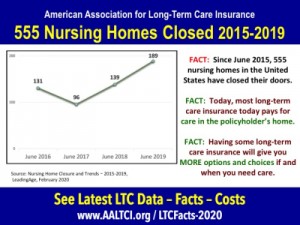

In the past five years a total of 555 nursing homes have closed, an important consideration for aging Americans shares the director of the American Association for Long-Term Care Insurance.

In the past five years a total of 555 nursing homes have closed, an important consideration for aging Americans shares the director of the American Association for Long-Term Care Insurance.

“Since 2015, nursing homes across the country have been closing and it’s not because of a lack of people needing care,” explains Jesse Slome, director of the long-term care insurance industry group. “It’s a matter of profitability and there are simply not enough people with savings or insurance who are covering the gap in what’s paid by Medicaid, the federal welfare program for poor seniors.”

The closure of nursing homes is an important fact that insurance agents who market long-term care insurance should be prepared to share with prospects. “First, consumers associate long-term care insurance with a need for nursing home care,” Slome notes. “That is simply not the case. The vast majority, about two-thirds of all long-term care insurance claim benefit dollars pay for care in the policyholder’s own home.”

“You want to stress that long-term care insurance increasingly is what I call nursing home avoidance insurance,” Slome advises. “When one needs care, the overwhelming preference is to be cared for at home and with more nursing homes closing and others facing financial pressures, the future outlook should encourage more people to have some financial protection in place.”

The latest data on nursing homes comes from a report publish this month by LeadingAge. “The report shared that nursing home occupancy has declined by two percent over four years (2015-2019). “That is despite 555 nursing homes being closed,” Slome shared with leading long-term care insurance professionals.

According to Slome. Medicaid pays for more than 60 percent of nursing home care. “Medicaid’s underpayment for services can reach as high as $23,000 per-resident,” Slome adds. “You can’t stay open or provide the necessary quality of service when you are underpaid for the majority of your residents and unless one expects significant increases in government payments, the outlook isn’t going to get better for the foreseeable future.”

“Long-term care insurance is not a solution for every American who is going to reach the ages of 80, 90 or even 100, but it’s an important option for those who want choices and options in the years ahead,” Slome concluded. “It’s the golden rule of care; those who have the gold will make the rules in terms of where, when and how they are cared for. And, even a modest long-term care insurance benefit will be worth it’s weight in gold.”

To learn more about long-term care planning visit the Association’s website or to connect with a specialist who can explain both traditional and hybrid products contact the Association via their website or call 818-597-3227.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!