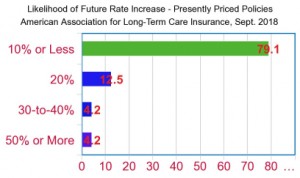

Risk of long term care insurance rate increases, credit: American Association for Long-Term Care Insurance study, September 2018

Los Angeles, CA – September 17, 2018 – Individuals who purchase a new long-term care insurance policy face little if any chance of a future rate increase according to a study of pricing experts released by the American Association for Long-Term Care Insurance.

“Policies priced years ago using different assumptions have seen rate increases so consumers today assume they face the same risk,” explains Jesse Slome, director of the Association. “That’s simply not the case.” The national organization just released results of a poll of actuaries across the long-term care insurance industry.

“Most actuaries responding see little or no the risk of needing future rate increases on recently priced policies,” according to Slome. Some 79.1 percent of the responding actuaries expressed the risk was 10 percent or less.

Older long-term care insurance policies priced 10 or 20 years ago used different pricing assumptions and generally had specific policy provisions that necessitated the need for increases. “Back in the 1990s, long-term care insurance was a new form of protection and there just wasn’t the data available,” Slome notes. “With several decades of experience and millions of policies sold and hundreds of thousands of claimants, policies priced today can more accurately project important aspects.”

Rate of Future Increase Is “Zero”

“I believe the risk of a future rate increases is zero,” projects Slome. “Rising interest rates and the new regulations mean someone purchasing a new long-term care insurance policy in 2018 and 2019 faces little if any chance of a future rate increase,” Slome projects. “Older policies with provisions like unlimited policy benefits or compounded annual benefit increases of five percent may face rate increases, but even these are never take-it or leave-it propositions. Insurers always offer options that enable the policyholder to avoid the increase.”

For the study, the American Association for Long-Term Care Insurance polled nearly 80 LTC industry actuaries. The professionals who price insurance policies were asked their assessment for policies now being sold that were priced within the past two years.

According to the Association, some eight million Americans have some form of long-term care insurance in place. The vast majority of policy owners have what is called a traditional, health-based policy. Over the past few years, sales of linked-benefit or life insurance policies that offer an option for long-term care benefits have increased in popularity.

The American Association for Long-Term Care Insurance advocates for the importance of planning and helps consumers connect with knowledgeable professionals who are independent advisors. Consumers looking for local long-term care insurance agents or cost comparisons should visit the Association’s website at www.aaltci.org or can call the organization’s national headquarters at 818-597-3227.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!