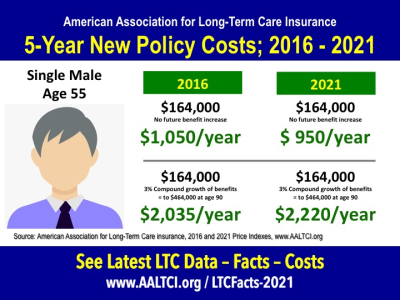

The cost for certain long-term care insurance policy designs has not changed significantly over the past five years according to the American Association for Long-Term Care Insurance (AALTCI).

“For men, rates actually may have declined slightly from where they were five years ago,” explains Jesse Slome, director of the long-term care insurance organization. ”Policy costs for women are about the same until you add an inflation growth option, then there is a significant increase.”

“For men, rates actually may have declined slightly from where they were five years ago,” explains Jesse Slome, director of the long-term care insurance organization. ”Policy costs for women are about the same until you add an inflation growth option, then there is a significant increase.”

The analysis is based on a comparison of the Association’s annual long-term care insurance Price Index data. “In 2016, a 55-year-old male would pay $1,015 annually for a policy that provided $164,000 in long-term care benefits,” Slome shares. “According to the 2021 Price Index, a 55-year-old male would pay $950 yearly for the same level of coverage. Adding the three percent compound inflation option did not dramatically increase what a male would pay for coverage.”

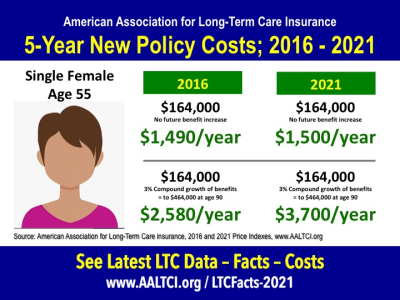

LTC Policy Costs 2016-2021 For Women

The same is not true for single women. “Women account for the vast majority of long-term care insurance claims so it’s to be expected that costs for their coverage would be higher,” Slome notes. “Policy benefits that are guaranteed to grow by three percent annually are going to cost more because we are in such a low interest rate environment.”

In 2016 according to the AALTCI Long-Term Care Insurance Price Index a woman age 55 would have paid $2,580 for $164,000 of immediate benefits growing to $400,000 at age 85. In 2021, the Association reports coverage with the inflation growth option will cost $3,700 annually at the time of purchase.

Costs for policies with no inflation growth option cost more for women (than men) BUT the costs have NOT increased over the five year period. “As interest rates drop, insurers need to charge more for a policy that is designed to grow,” Slome adds. “However, today, women can find policies that will grow at 1 or 2 percent annually and those will cost less than one growing at 3 percent yearly.”

Costs for policies with no inflation growth option cost more for women (than men) BUT the costs have NOT increased over the five year period. “As interest rates drop, insurers need to charge more for a policy that is designed to grow,” Slome adds. “However, today, women can find policies that will grow at 1 or 2 percent annually and those will cost less than one growing at 3 percent yearly.”

The Association gathers data each year for common levels of long-term care insurance being purchased by consumers.

The American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of planning and supports insurance professionals who market both traditional and hybrid LTC solutions. To obtain long-term care insurance costs from a long-term care insurance specialist call the organization at 818-597-3227 or visit their website.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!