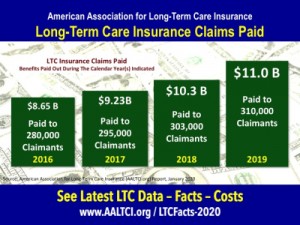

Claim benefits paid by the nation’s long-term care insurers have increased by just over 35 percent over the past five years according to the American Association for Long-Term Care Insurance (AALTCI).

Claim benefits paid by the nation’s long-term care insurers have increased by just over 35 percent over the past five years according to the American Association for Long-Term Care Insurance (AALTCI).

“In 2019 the long-term care insurance companies paid out $11 billion in claim benefits to some 310,000 individuals,” reports Jesse Slome, AALTCI’s director. ”That represents a 35.11 percent increase over the $8.14 billion paid out five years earlier in 2015.”

Long-term care insurance claims continue to increase as more Americans who own this valuable coverage age and require care. The Association reports annual claim benefits paid out to individuals who receive benefits for qualifying care in their own home, in assisted living facilities or in skilled nursing home settings.

“The number of individuals who received benefit payments has grown as policyholders age,” Slome cites. “Long-term care insurance is something you buy generally in your 50s and 60s fully expecting that if you live a long life, you’ll need care one day. Insurers understand and expect this as well.”

The majority of long-term care insurance claim benefits are paid to individuals who purchased traditional long-term care insurance policies. “While the majority of policies purchased today are life and annuity policies that offer the option for a long-term care payout, there are relatively few claims apparently for LTC -related benefits,” Slome points out. “Hopefully one day as that segment of the industry grows such information will be available to demonstrate to consumers the value of this protection.”

Data on long-term care insurance claims paid can be accessed on the Association’s website. To see 2020 statistical reports go to https://www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2020.php and from that page one can access data from prior years.

Established in 1998, the American Association for Long-Term Care Insurance advocates for the importance of long-term care planning. The organization connects consumers with knowledgeable professionals who are independent advisors for no-cost, no-obligation long-term care insurance costs quotes and policy comparisons of both traditional and linked benefit long-term care insurance options.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!