Long-Term Care Insurance Facts - Data - Statistics - 2020 Reports

The information and data provided below from the American Association for Long-Term Care Insurance is based on data researched or gathered by the organization. Information may be used with proper citation (Data from the American Association for Long-Term Care Insurance, www.aaltci.org).

Click Here To Access 2019 Data & Statistics (2019 Association Studies)

Click Here To Access 2018 Data & Statistics (2018/2017 Association Studies)

2020 Long-Term Care Insurance Information - Click on the links to 'jump'

- Americans With Long-Term Care Insurance (2020)

- Top States For Long-Term Care Insurance Coverage

- Buyers' Ages for Long-Term Care Insurance Policies (2019)

- Long-Term Care Insurance Policy Price Index (2020)

- Comparison of Long-Term Care Insurance Prices, 2015 versus 2020

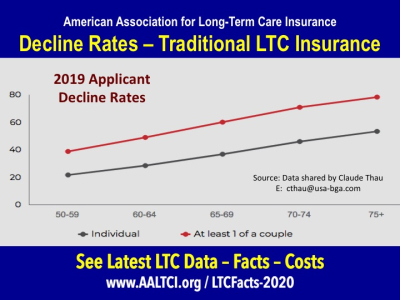

- Decline Rates for Long-Term Care Insurance Applicants (Individuals)

- Decline Rates for Long-Term Care Insurance Applicants (Couples)

- Compare Traditional Long-Term Care Insurance to Linked Benefit - NO Inflation Growth

- Compare Traditional Long-Term Care Insurance to Linked Benefit - WITH Inflation Growth

- Long-Term Care Insurance Price Index 2020

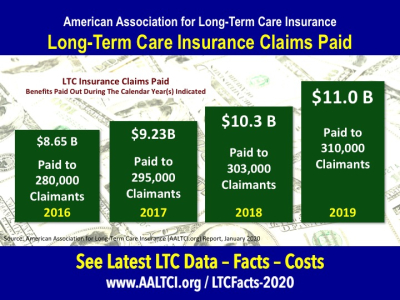

- Long-Term Care Insurance Claims Paid (2019)

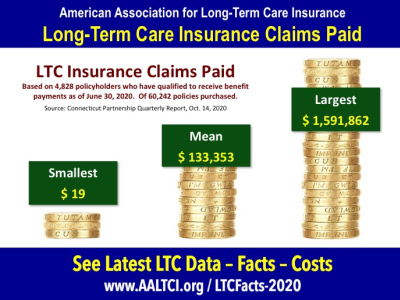

- Long-Term Care Insurance Claims - Smallest and Largest (2020)

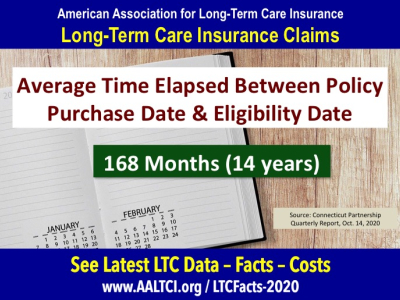

- Elapsed Time From Policy Purchase To Claim (2020)

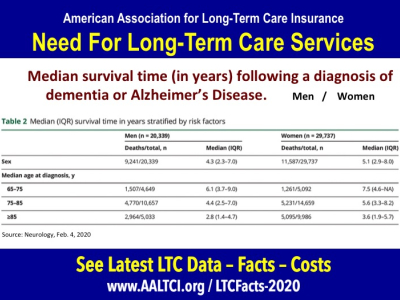

- LTC Need: How Many Years People Survive After Alzheimer's Diagnosis

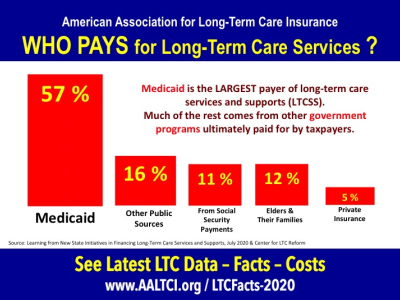

- Medicaid Pays for Most Long-Term Care Support Services

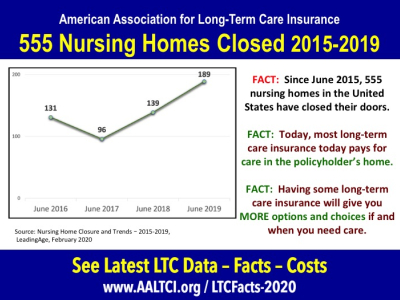

- Nursing Home Closures (2015 - 2019)

Americans With Long-Term Care Insurance Protection - 2020

7.5 million Americans have some form of long-term care insurance as of January 1, 2020. Includes traditional LTCi as well as linked-benefit - IRS 7702(G) and 101(b) - products.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2020, www.aaltci.org"

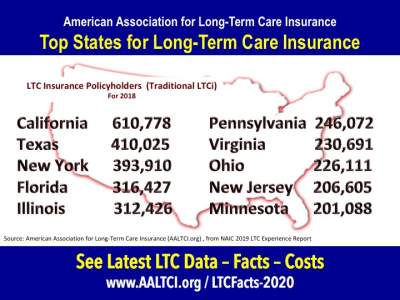

Back to TopTop States For Long-Term Care Insurance Coverage

The top 10 states where residents have purchased traditional long-term care insurance protection (latest data from 2019 NAIC reports).

When citing data, please credit: "American Association for Long-Term Care Insurance, 2020, www.aaltci.org"

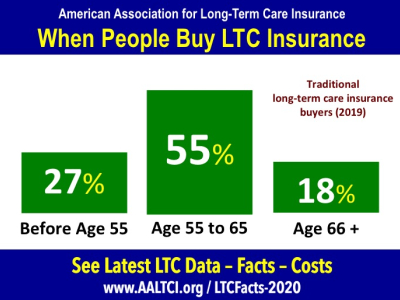

Back to TopBuyers Ages for Long-Term Care Insurance

The recommended age to apply for (and purchase) long-term care insurance is between ages 55 and 65 when being able to meet the 'health requirements' imposed by insurers is more likely.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2020, www.aaltci.org"

Back to TopCompare Traditional Long-Term Care Insurance to Linked Benefit - NO Inflation Growth

| Traditional Long-Term Care Insurance Policy - NO INFLATION GROWTH - YEARLY PREMIUMS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 | $ 875 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 | $ 1,350 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company A - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 / Max. Death Benefit = $130,000 | $ 3,625 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 / Max. Death Benefit = $130,000 | $ 3,400 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company A - ONE SINGLE PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 / Max. Death Benefit = $130,000 | $ 83,762 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 / Max. Death Benefit = $130,000 | $ 73,510 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company B - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 / Max. Death Benefit = $130,000 | $ 5,010 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 / Max. Death Benefit = $130,000 | $ 4,550 | |

Rates above are for an initial pool of benefits based on an initial benefit of $5,000-per-month with a 3-year-benefit period.

NO INFLATION GROWTH OPTION so benefit pool WILL NOT INCREASE. Prices for State of AZ. Prices can vary by State. Calculated: January 2020

Compare Traditional Long-Term Care Insurance to Linked Benefit - WITH 3% Annual Inflation Growth

| Traditional Long-Term Care Insurance Policy - With 3% Annual Growth - YEARLY PREMIUMS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits @ Age 90 = $505,000 | $ 1,710 | |

| Single Female, Age 55 - Pool of LTC Benefits @ Age 90 = $505,000 | $ 2,750 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company A - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits @ Age 90 = $505,000 / Max. Death Benefit = $130,000 | $ 5,278 | |

| Single Female, Age 55 - Pool of LTC Benefits @ Age 90 = $505,000 / Max. Death Benefit = $130,000 | $ 5,500 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company B - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits @ Age 90 = $505,000 / Max. Death Benefit = $130,0000 | $ 6,710 | |

| Single Female, Age 55 - Pool of LTC Benefits @ Age 90 = $505,000 / Max. Death Benefit = $130,000 | $ 7,010 | |

Rates above are for an initial pool of benefits based on an initial benefit of $5,000-per-month with a 3-year-benefit period.

Includes a 3% annual inflation growth option so benefits increase each year the policy is in place.. Prices for State of AZ. Prices can vary by State. Calculated: January 2020

Long-Term Care Insurance Policy Costs - 2020

| Annual Premium - Age 55 - Average of Leading LTC Insurance Companies | ||

|---|---|---|

| Single Male, Age 55 (Select Health) benefits grow at 3% yearly | $ 1,700 | |

| Single Female, Age 55 - benefits grow at 3% yearly | $ 2,675 | |

| Couple, Both Age 55 (cost shown is COMBINED for the couple) 3% annual growth | $ 3,050 | |

| Annual Premium - Age 65 - Good Health vs. Some Health Issues When Applying | ||

|---|---|---|

| Single Male, Age 65 (Preferred Health) | $ 1,400 | |

| Single Male, Age 65 (Some Health Issues) | $ 2,100 | |

| Single Female, Age 65 (Preferred Health) | $ 2,100 | |

| Single Female, Age 65 (Some Health Issues) | $ 3,100 | |

Rates shown above are for an initial pool of benefits equal to $162,000 (each at age 65). If you have some health issues, call the Association to discuss. Prices for State IL. Prices can vary by State. Calculated: February 2020

Back to Top

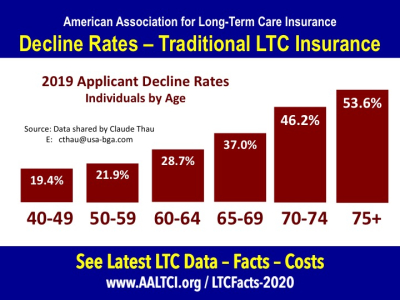

Decline Rates for Long-Term Care Insurance Applicants (Individuals)

Individuals must health qualify in order to get long-term care insurance coverage. The older you get, the more likely you will have health issues that will not be acceptable to an insurance company.

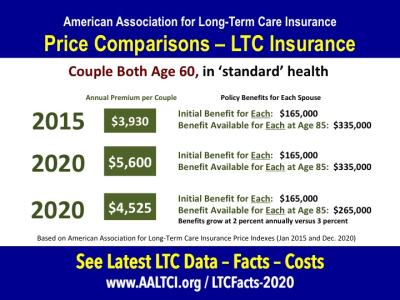

Comparison of Costs for Long-Term Care Insurance 2015 versus 2020

Prices for policies in 2020 have increased compared to 2015. This is primarily true if you want a policy where the available benefits increase by 3 percent annually. Instead, consider one that grows at 2 percent (annually). Or, ask a specialist about policies that allow you to save now and increase your benefits down the road (if you want to).

Decline Rates for Long-Term Care Insurance Applicants (Couples)

This chart shows the likelihopod that at least one spouse (or partner) of a 'couple' will be declined coverage by the LTC insurance company.

Long-Term Care Insurance Claims Paid (2019)

The nation's long-term care insurers paid out $11 Billion in claim benefits in 2019. This number represents almost entirely benefits paid to those with traditional long-term care insurance. Very few policyholders with linked benefit policies are receiving claim benefits at this time.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2020, www.aaltci.org"

Back to TopLong-Term Care Insurance Claims- Smalled and Largest (2020)

The Connecticut Long-Term care program has reported data since the 1990s. Based on a total of 4,828 claimants.

Elapsed Time From Policy Purchase to Claim (2020)

The Connecticut Long-Term care program has reported data since the 1990s. Based on a total of 4,828 claimants.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2020, www.aaltci.org"

Back to TopLTC Need: How Many Years People Survive After Alzheimer's Diagnosis

Click the link to read the research on survival rate for men and women age bands 65-75, 75 to 85, 85 and older. Click this link to read more.

Medicaid & Other Government Programs Pay for Most LTC Support Services

Nursing Home Closures (2015 - 2019)

Read why AALTCI refers to long-term care insurance as 'nursing home avoidance' insurance and why the growing rate of closures matters. Click this link to read more.

REPORTERS - EDITORS & BLOGGERS

If you would like additional information please call or email Jesse Slome, Executive Director of the American Association for Long-Term Care Insurance.

Phone: 818-597-3227

Click Here To Email Jesse Slome