Long-Term Care Insurance Facts - Data - Statistics

The following facts are provided by the American Association for Long-Term Care Insurance based on data researched or gathered by the organization. Information may be used with proper citation (Data from the American Association for Long-Term Care Insurance, www.aaltci.org).

- Long-Term Care Insurance Policy Costs

- Long-Term Care Insurance Claims

- Largest Long-Term Care Insurance Claims Paid (2017)

- Decline Rates For LTC Insurance Applicants

- Long-Term Care Insurance Tax Deductible Limits - 2018

Long-Term Care Insurance Policy Costs - 2018

| Annual Premium - Average of Leading LTC Insurance Companies | ||

|---|---|---|

| Single Male, Age 55 (Select Health) | $ 1,870 | |

| Single Female, Age 55 | $ 2,965 | |

| Couple, Both Age 55 (cost shown is COMBINED for the couple) | $ 3,000 | |

| Single Male, Age 60 (Select Health) | $ 2,010 |

| Single Female, Age 60 | $ 3,475 |

| Couple, Both Age 60 (cost shown is COMBINED for the couple) | $ 3,490 |

| Single Male, Age 65 (Select Health) | $ 2,460 |

| Single Frmale, Age 65 | $ 4,270 |

| Couple, Both Age 65 (cost shown is COMBINED for the couple) | $ 4,675 |

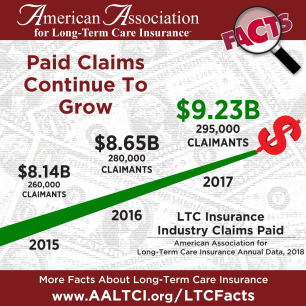

Long-Term Care Insurance Claims Paid - 2015 thru 2017

Based on 2018 American Association for Long-Term Care Insurance annual claims paid survey. Represents total of all claims paid for traditional long-term care insurance policies during the year (in Billions) and the number of individuals on claim on a specific date (Dec. 31st of each year).

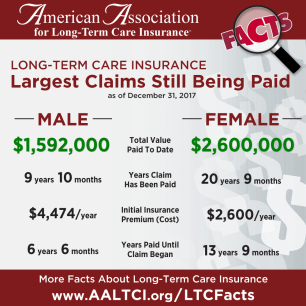

Largest Long-Term Care Insurance Claims Paid - Thru December 31, 2017

| Largest Claims Paid - Company 1 | ||

|---|---|---|

| FEMALE | MALE | |

| Total Value of Claim Paid To Date | $ 2.6 Million | $ 1.7 Million |

| Number of Years This Claim Has Been Paid | 20 years - 9 months | 7 years - 4 months |

| Time From Policy Purchase to Claim Inception | 13 years 9 months | 15 years - 4 months |

| Initial Premium for This Policyholder | $ 2,600 | $ 6,600 |

| Largest Claims Paid - Company 2 | ||

|---|---|---|

| FEMALE | MALE | |

| Total Value of Claim Paid To Date | $ 2,396,944 | $ 1,592,332 |

| Number of Years This Claim Has Been Paid | 14 years - 4 months | 9 years - 10 months |

| Time From Policy Purchase to Claim Inception | 8 years - 1 month | 6 years - 6 months |

| Initial Premium for This Policyholder | $ 10,881 | $ 4,474 |

| Largest Claims Paid - Company 3 | ||

|---|---|---|

| FEMALE | MALE | |

| Total Value of Claim Paid To Date | $ 1,498,508 | $ 1,269,894 |

| Number of Years This Claim Has Been Paid | 8 years - 10 months | 14 years - 0 months |

| Time From Policy Purchase to Claim Inception | 15 years - 1 month | 9 years - 5 months |

| Initial Premium for This Policyholder | $ 3,696 | $ 4,968 |

| Largest Claims Paid - Company 4 | ||

|---|---|---|

| FEMALE | MALE | |

| Total Value of Claim Paid To Date | $ 1,453,944 | $ 811,234 |

| Number of Years This Claim Has Been Paid | 11 years - 2 months | 12 years - 5 months |

| Time From Policy Purchase to Claim Inception | 5 years - 3 months | 7 years - 3 months |

| Initial Premium for This Policyholder | $ 3,564 | $ 4,416 |

| Largest Claims Paid - Company 5 | ||

|---|---|---|

| FEMALE | MALE | |

| Total Value of Claim Paid To Date | $ 1,440,322 | $ 1,312,647 |

| Number of Years This Claim Has Been Paid | 14 years - 6 months | 9 years - 6 months |

| Time From Policy Purchase to Claim Inception | 4 years - 1 month | 2 years - 9 months |

| Initial Premium for This Policyholder | $ 1,778 | $ 3,320 |

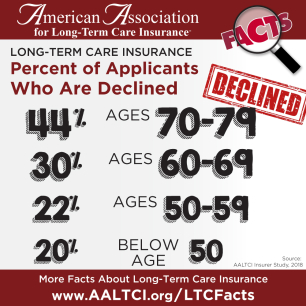

Decline Rates For LTC Insurance Applicants (2017)

Source: American Association for Long-Term Care Insurance study of data from leading traditional LTC insurers. April 2018.

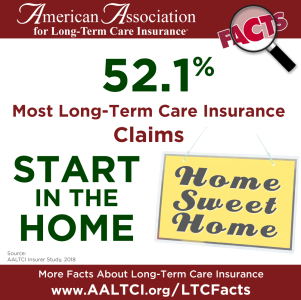

Most Long-Term Care Insurance Claims Begin At Home

Source: American Association for Long-Term Care Insurance study of data from leading traditional LTC insurers. April 2018.

Long-Term Care Insurance Tax Deductible Limits - 2018

AS YOU AGE … YOUR TAX DEDUCTIBLE LIMIT INCREASES

Tax-qualified LTCi premiums are considered a medical expense. For an individual who itemizes tax deductions, medical expenses are deductible to the extent that they exceed current amount required to meet the individual's Adjusted Gross Income (AGI). The amount of the LTCi premium treated as a medical expense is limited to the eligible LTCi premiums, as defined by Internal Revenue Code 213(d), based on the age of the insured individual. That portion of the LTCi premium that exceeds the eligible LTCi premium is not included as a medical expense.

Individual taxpayers can treat premiums paid for tax-qualified long-term care insurance for themselves, their spouse or any tax dependents (such as parents) as a personal medical expense.

The Association does not provide tax advice. Speak with your accountant for specific rules and limits that apply.

2018 Long Term Care Insurance Federal Tax Deductible Limits

| Taxpayer's Age At End of Tax Year - Deductible Limit | ||

|---|---|---|

| 40 or less | $ 420 | |

| More than 40 but not more than 50 | $ 780 | |

| More than 50 but not more than 60 | $1,560 | |

| More than 60 but not more than 70 | $4,160 | |

| More than 70 | $5,200 | |

Source: IRS Revenue Procedure: 2017-58

Back to Top

REPORTERS - EDITORS & BLOGGERS

If you would like additional information please call or email Jesse Slome, Executive Director of the American Association for Long-Term Care Insurance.

Phone: 818-597-3227

Click Here To Email Jesse Slome