Is your annuity currently valued at $100,000 or more?

Are you past 'surrender' penalty period (typically 7 to 9 years)?

Would you prefer avoiding future taxation of annuity payouts?

PLUS get more money to pay for long-term care!

If you answered YES to the questions above, keep reading.

We Explain How To Tax-Free "1035 Convert" Your Current Annuity

To A NEW, BETTER ANNUITY WITH 2x or 3x THE LTC BENEFITS!

This information is designed to benefit readers. The American Association for Long-Term Care Insurance does NOT offer or provide tax advice. We always advise speaking to a qualified financial advisor and your tax advisor. And, if you any questions, please feel free to call us at 818-597-3227.

GET NO-COST, NO-OBLIGATION INFO AND AN

EXAMPLE OF NEW BENEFITS FROM 1 LTCi SPECIALIST

CLICK Here to E-mail the Association

A REAL EXAMPLE OF HOW THE ANNUITY PLUS LTC CAN BENEFIT YOU

Let's give a real life example that shows how you can benefit. The following is for a couple, both age 70 who currently have a non-qualified annuity presently worth $150,000.

On the LEFT we show what happens if the couple keep their annuity in place.

The value grows. If one (or both) need long-term care at age 90, they decide to withdraw funds. Let's be ultra conservative and say the annuity company ONLY credits 1 percent interest annually.

At age 90, the annuity is now worth $181,216. THE FIRST $106,216 WITHDRAWN MAY BE TAXABLE as it represents the GAIN over the initial $75,000 paid.

On the RIGHT we show what could happen IF THE COUPLE completes a 1035 Exchange into an annuity with the special tax advantages now available for long-term care.

First, there are NO TAX CONSEQUENCES for completing a 1035 exchange. But we strongly advise you work with a pro who knows how to do it!

Let's still be conservative and say the new annuity grows at the MINIMUM interest rate guaranteed by the insurer (1% and then 0.10%). At age 90, the NEW ANNUITY's LONG-TERM CARE MAXIMUM BENEFITS EQUAL $460,912.

If the insurer credits a higher interest rate (very likely!) IT COUPLE BE WORTH MUCH MORE thanks to the special 3x leverage for long-term care payments. The example we ran showed $726,654 at age 90. That's a significant LEVERAGE BONUS available to pay for long-term care!

PLUS, ALL FUNDS WITHDRAWN TO PAY FOR LONG-TERM CARE ARE RECEIVED TAX FREE.

The tax avoidance PLUS the leveraged benefits available for long-term care are reasons to investigate this planning strategy in greater detail.

A BRIEF OVERVIEW OF THE ANNUITY - LONG-TERM CARE STRATEGY

Millions of Americans have Non-Qualified Annuities purchased to build their retirement savings. Many consider their annuity as "emergency funds" for a healthcare need or long-term care.

A Non-Qualified Annuity's value grows tax-deferred UNTIL you start taking money out. Then the "gain" is subject to taxation. Simply explained, if you 'invested' $50,000 and the annuity is now worth $100,000, you could pay income taxes on the first $50,000 withdrawn (your "gain").

"THE OLD WAY" - PITFALLS OF TRADITIONAL NON-QUALIFIED ANNUITIES1. Funds withdrawn can become taxable income - EVEN if used to pay for long-term care expenses.

2. Future amounts typically grow. But they are NOT 'multiplied' for special needs (like long-term care).

For years, the U.S. government has encouraged seniors to plan for long-term care. Congress has enacted multiple tax incentives that can benefit you. Certain non-qualified annuities meet the IRS regulations. These can provide you with significant advantages, including:

1. All funds withdrawn from the annuity to pay for long-term care are NOT subject to taxation.

2. The insurer "multiplies" the annuity value. This can double or triple the annuity's value IF you need long-term care?

THE 1035 ANNUITY EXCHANGE STRATEGY FEW PEOPLE ARE AWARE OF

Your old non-qualified annuity can be exchanged for a new annuity+LTC that has the newer advantages.

This is done via a 1035 exchange. A 1035 exchange is a provision in the Internal Revenue Service (IRS) code allowing for a tax-free transfer of an existing annuity contract, life insurance policy for another one of like kind

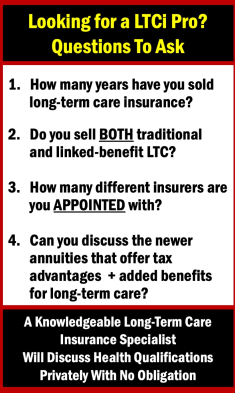

The benefits of a 1035 exchange can be great. But, be advised, it isn't always an easy process. You really want to be sure you are working with a seasoned insurance professional with 1035 exchange experience.

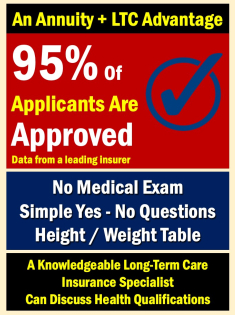

HEALTH REQUIREMENTS FOR AN ANNUITY WITH EXTRA LONG-TERM CARE BENEFITS

It's generally easier to health qualify for one of the new annuities that offer these added tax and long-term care benefits. However, the insurer will still decline people. Here are some examples.

You likely will be declined if:

If you've applied for and been declined for long-term care insurance.

Have used a walker, wheelchair, dialysis machine or scooter in the past year.

Been diagnosed with Alzheimer's or dementia in the last 7 years.

Your weight is outside of the general standards (not considered obese).

If you have some medical issues, it can still pay to have a quick conversation with a long-term care insurance professional. He or she can quickly tell you whether any of these options will be available to you.

SOME THINGS YOU SHOULD KNOW ABOUT THESE ANNUITIES

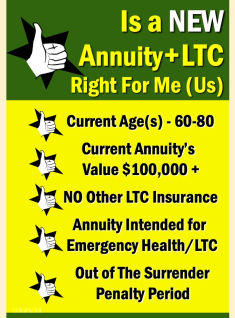

Here are some things we think are important to keep in mind if you are considering a 1035 exchange into a new annuity with LTC leverage.

A 1035 exchange MUST BE DONE correctly to avoid tax issues. Work with a pro!

This is an ideal planning strategy generally for those between ages 60 and 80.

Especially for seniors who have no long-term care insurance in place.

Insurers typically won't require a medical exam, but they will have some health criteria to meet.

If you never need long-term care, the annuity still has value to you and/or your heirs.

Annuities usually offer a great first-year interest rate. Ask what it is.

Also ask the insurance agent for a rate history (what they've paid in subsequent years).

Some of the annuities only offer the added leverage for LTC up to age 100.

The new annuity will have a surrender penalty if you withdraw during the early years.

Speak Directly To A Long-Term Care Insurance Specialist

Call the Association offices (weekdays between 9AM and 1PM, Pacific Time) at 818-597-3227. We can answer general questions. And, IF YOU LIKE have 1 LTC specialist connect with you.

E-Mail to Learn More (Click the underlined link:) Email The Association Now

Why Seniors Purchase Non-Qualified Annuities?

Here are facts about annuity owners. Reasons people purchased and why seniors own non-qualified annuities.

84% purchased as a FINANCIAL CUSHION for major expenses (such as long-term care).

65% of annuity owners are RETIRED.

The average age of an annuity owner is 70.

34% DON'T EXPECT TO TAKE MONEY OUT unless an emergency arises.

51% of OWNERS are FEMALE.

Source: Gallup Organization report on Annuity Ownership (2022)Other Valuable Resources for Consumers

2024 Long-Term Care Insurance Statistics

Long-Term Care Insurance Prices at Ages 55, 60 and 65

Best Medicare Insurance Statistics

Find A Find A Medicare Insurance Agent Near Me - Free Online Directory

Best Medigap Plan G Costs 2024 Data for Top-10 U.S. Metros

LEARN MORE

Request No-Obligation

Information & Costs

Call: 818-597-3227

- Or -

Email The Association Now

E-mail The Association To Request

No-Cost, No-Obligation Information

E-mail The Association To Request

No-Cost, No-Obligation Information

E-mail The Association To Request

No-Cost, No-Obligation Information

E-mail The Association To Request

No-Cost, No-Obligation Information