Costs for new long-term care insurance policies (2015-2020) have increased by 42.5 percent compared to five years ago according to the American Association for Long-Term Care Insurance (AALTCI).

Costs for new long-term care insurance policies (2015-2020) have increased by 42.5 percent compared to five years ago according to the American Association for Long-Term Care Insurance (AALTCI).

“The are reasons why the increase is so dramatic and there are also smart ways for consumers to save significantly on this important coverage,” explains Jesse Slome, director of the long-term care insurance organization.

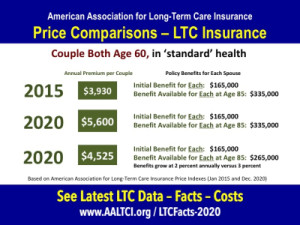

According to the Association’s 2015 Long-Term Care Insurance Price Index, a 60-year old couple could expect to pay around $3,930 annually for a typical policy. “We reported costs for a policy that provides each spouse with an initial benefit of $165,000 growing to $335,000 when they reach age 85,” Slome notes. The typical individual with long-term care insurance generally begins to need care in their 80s or later.

Comparable coverage according to the organization would currently cost $5,600. “The available benefits in these policies grow by three percent compounded annually and that’s a major reason for the cost increase,” Slome explains. “For that reason, people today often prefer coverage growing by one or two percent annually which can dramatically lower the cost of coverage.”

Slome noted that one option available enables the policyholder to begin with a lower growth rate and increase the level in the future. “Not all companies make an option like this available, which is one reason we strongly recommend working with a knowledgeable specialist who can compare multiple policies from multiple companies,” he adds.

A large part of the cost increase is attributable to the low interest rate environment. “To increase available benefits by three percent yearly, insurance companies need to invest customers premiums,” Slome explains. “With interest rates so low, they need to increase new premium costs but they are offering other options for those looking for cost-saving options.”

The American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of planning and supports insurance professionals who market different options including short-term care as well as both traditional and hybrid LTC solutions. To get information or request long-term care insurance quotes from a specialist in your area call the organization at 818-597-3227 or visit their website at www.aaltci.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!