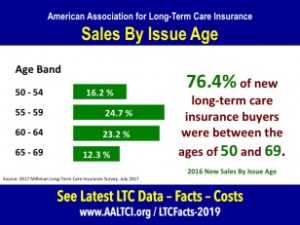

The vast majority of buyers of traditional long-term care insurance policies are between the ages of 50 and 69 reports Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI).

The vast majority of buyers of traditional long-term care insurance policies are between the ages of 50 and 69 reports Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI).

“Just over 76 percent of new buyers of a long-term care insurance policy do so after turning age 50 and before they turn 70,” AALTCI’s director shared with insurance professionals who market the protection. “It is important to understand the marketplace in order to know how to effectively communicate with prospective buyers.”

Slome shared that most buyers today are between ages 55 and 59 (24.7%) or between 60 and 64 (23.2%). “The sweet spot for buying traditional health-based long-term care insurance is between 55 and 65, before you go onto Medicare,” Slome noted.

“Once on Medicare, many individuals take advantage of the excellent health preventative tests ad covered doctors visits, which is a good thing because these exams often detect problems that can be addressed,” Slome explained. “But, the exams also can uncover conditions that may make it impossible for an individual to health qualify for long-term care insurance. That’s why we urge action prior to reaching Medicare age.”

Slome urged planning for long-term care begin prior to age 65. “There are many reasons to plan prior to turning age 65,” Slome explained. “If you want long-term care insurance to be an option, meeting the insurer’s health qualifications is more difficult after 65 and, of course, insurance is less expensive if you lock in coverage at younger ages.”

Data on long-term care insurance sales by issue age as well as the most recent data on benefit period selected was posted on the Association’s website and can be accessed at https://www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2019.php

The American Association for Long-Term Care Insurance advocates for the importance of long-term care planning. Established in 1998, the organization connects consumers with knowledgeable professionals who are independent advisors for no-cost, no-obligation long-term care insurance costs quotes and policy comparisons.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!