The overwhelming majority of consumers experiencing a premium increase on their long-term care insurance chose to pay the higher premium. The findings of a new analysis were released today by the American Association for Long-Term Care Insurance.

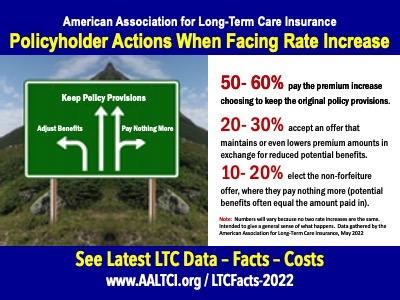

“Between 50 and 60 percent of policyholders choose to keep their original policy benefit levels and pay the increased premium,” explains Jesse Slome, American Association for Long-Term Care Insurance director. ”While no one likes to pay more money, these individuals recognize the value of this protection because they are older and thus closer to the risk of needing long-term care.”

According to the Association between 20 and 30 percent of individuals notified of an approved premium increase chose to adjust their policy provisions. “Many buyers initially selected the 5 percent inflation growth option,” Slome notes. “When they review their policy benefits along with their present financial situation, it often makes sense to reduce the growth factor and thus avoid the premium increase. In some cases, they may even pay less money for their continued long-term care insurance coverage.”

Between 10 and 20 percent of consumers elect the non-forfeiture option Slome shares. “Typically, these individuals will stop paying premiums but will still qualify for benefits should they need qualifying care,” Slome notes. “The last time we conducted such an analysis, it was common for only 1-3 percent of policyholders to drop coverage,” Slome adds.

The long-term care insurance executive attributed the change to ‘premium increase fatigue’ as well as two other factors. “The long-term care insurance industry has failed to convey to consumers how this protection is benefiting hundreds of thousands of families each year,” Slome shares.

“And, for some, the value of accrued benefits are perceived to be sufficient for meeting future needs. Paying continued premium is viewed as no longer making financial sense.”

Rate Increases – Long-Term Care Insurance Data

Rate Increase and other long-term care insurance statistics, To access the latest long-term care insurance statistics go to https://www.aaltci.org/ltcfacts-2022.php.

The American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of long-term care planning and supports insurance professionals who market both traditional and hybrid long-term care solutions. To access information go to https://www.aaltci.org or call the organization at 818-597-3227.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!