It may be possible to get long-term care insurance after you have health issues.

But, it's very important that you understand how to increase your chances of health-qualifying.

NOT EVERYONE WHO WANTS TO BUY LONG-TERM CARE INSURANCE CAN MEET THE HEALTH QUALIFICATIONS.

Insurance companies ONLY ACCEPT applications from those who can meet extensive health qualifications.

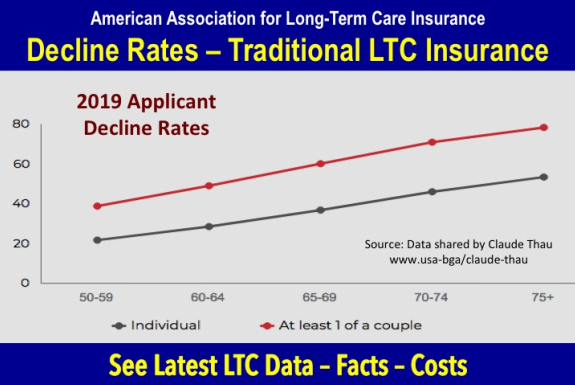

A significant number of people who apply each year are DECLINED because of current and prior health-related issues. See the chart below for age-based statistics on decline rates.

EVEN IF YOU HAVE HEALTH ISSUES you may be able to qualify for long-term care insurance. Or, you may qualify for what's called 'short-term care insurance'. These policies may cover care at home, in assisted living and skilled nursing facilities, generally for up to one year.

THIS IS IMPORTANT! If you have health issues (or take multiple prescription medications) you want to look for an insurance company that will accept you. A DECLINE FROM ONE COMPANY can result in automatic declines from other insurers.

Long-term care insurers decline to accept applications from those with health issues

Long-term care insurance companies decline (will not issue insurance coverage) to individuals who do not meet their health requirements.

Acceptable standards do vary from one company to the next. And, as the chart shows, the older you are, the more likely that you will not meet health requirements.

Taking prescription medication can make you feel healthy (and that's good). But insurers know that taking certain medications can make you more likely to need long-term care down the road.

Best way to find out if you can "health" qualify for long-term care insurance

You can benefit by speaking with a long-term care insurance specialist* who understands the health requirements imposed by various insurance companies. * Specialist defined below.

Click Here to E-mail The Association. We'll Connect With ONE LTC Specialist

Call the American Association for Long-Term Care Insurance 818-597-3227 - Between 9AM and 3PM Pacific Time - to be connected with ONE specialist for your area.

WHAT IS A SPECIALIST? The American Association for Long-Term Care Insurance considers someone who 'specializes' as meeting the following criteria.

1. Long-term care insurance is a primary focus of their business.

2. They have been selling LTC insurance for five (5) years or longer.

3. They are 'appointed' with most of the major insurance companies.

4. They know BOTH traditional LTCi as well as hybrid LTC and (where available) short-term care insurance policies.

COMMON HEALTH CONDITIONS - - CAN YOU QUALIFY?

The information below is generalized and subject to change. Each insurer sets their own standards. To get the current info consult with a good LTC insurance specialist.

Does my weight matter ?

GENERALLY YES - Insurers typically have height/weight requirements. Here's an example for a man or woman who is 5' 9".

Minimum acceptable weight: 122 pounds.

Preferred Rate Maximum: 196 pounds (Preferred rate typically means a discounted policy rate)

Maximum Weight: 271 pounds

What if I have high blood pressure ?

DEPENDS - Your blood pressure needs to be well controlled with medication. Most carriers require readings less than 170 / 94.

What if you have diabetes ? Can you qualify for long-term care insurance?

DEPENDS - If you have Type 1 and are taking insulin (less than 50 units per day) with no other heart-related issues, you may be able to qualify for LTC insurance. For short-term care insurance policies you may qualify depending on if your diabetes is "under control."

What if you are experiencing some memory issues (senior moments) ?

DEPENDS - Acceptance will depend on the seriousness of the issue. If you have discussed your memory concerns with your physician, you definitely will not qualify for traditional long-term care insurance. There might be some home care insurance policies available depending on what state you live in.

What if you are on Social Security disability ? Can you qualify for long-term care insurance?

DEPENDS - You can't qualify for traditional long-term care insurance but you may be able to obtain coverage with one of the hybrid policies. For short-term care insurance policies you may qualify for a home care benefit if you are able to perform your ADLs (Activities of Daily Living).

What if you previously had cancer ? Can you qualify for long-term care insurance?

DEPENDS - It will depend on when you were diagnosed as well as what type of cancer and what stage. Was it only once or were there more than one diagnosis. There may be a waiting time following recovery.

What if you previously had a stroke ? Can you qualify for long-term care insurance?

YOU MAY QUALIFY - Acceptance varies by insurer. But one leading LTC insurer may accept an applicant who has had a single stroke more than two (2) years earlier. Short-term care insurance policies may be available after 2 years of time has passed. A home care policy may be accepted after one year of time has passed.

What if you are receiving physical therapy ? Can you qualify for long-term care insurance?

DEPENDS - If you are currently receiving therapy, the answer will be NO. Insurance carriers require that you be finished with therapy. Some require a waiting period that can range from 3 to 6 months.

What if you have MS (Multiple Sclerosis) ? Can you qualify for long-term care insurance?

CONSIDER A HOME CARE POLICY - Traditional long-term care insurance policies will not be an option. However, a home care policy may be a good alternative if you have no symptoms and depending on what medications have been prescribed. These policies are not available in all states and you should clearly understand what is neeed to qualify for benefits. However, for individuals who have MS, they can be a very viable option to have some coverage in place.

Best way to find out if you can "health" qualify for long-term care insurance

You can benefit by speaking with a long-term care insurance specialist who understands the health requirements imposed by each insurance company.

Click Here to E-mail The Association. We'll Connect With ONE LTC Specialist

Call the American Association for Long-Term Care Insurance 818-597-3227 - Between 9AM and 3PM Pacific Time - to be connected with ONE specialist for your area.

There is NO COST and NO OBLIGATION to buy from them.