If you are considering buying a long-term care insurance policy, here's how Covid-19 should affect your thinking.

ACTING NOW COULD BE BENEFICIAL. HERE'S WHY: 1. Some insurers have already raised costs and changed available plan benefits for new applicants (expect others to follow eventually). 2. Insurers have lowered the ages where they will accept applications. 3. Covid-19 is not YET a factor in accepting applicants for most companies. One company is postponing applications for individuals who have been in contact with Covid-19 infected individuals.

NURSING HOME "AVOIDANCE" INSURANCE: Covid-19 has killed over 40,600 nursing home residents (USA Today, June 2, 2020). It's made consumers even more aware of the need to find long-term care insurance that maximizes your ability to get care in your own home.

Scroll down to read more.

IMPORTANT NOTE: A top LTC insurer just announced policies submitted after August 31 will cost more. Call the Association today at 818-597-3227 who can advise and assist you.

Whether you are considering a traditional LTC policy or a 'linked-benefit' (Life+LTC) policy, there can be significant differences in coverage and pricing. To understand the differences, it pays to work with a knowledgeable "specialist" who can compare multiple policies and help get you the best coverage for the best price.

To Speak With a LTC Insurance Specialist

Call the American Association for Long-Term Care Insurance

818-597-3227

There is NO COST and NO OBLIGATION to buy from them.

Covid-19 & Long-Term Care Insurance Information

RATE INCREASES: In recent weeks several major insurance companies that offer traditional LTC or linked-benefit (Life+LTC) policies have announced rate increases for new applicants.

Some of the increases have been modest - others larger. A linked-benefit company started rate increases (NEW POLICIES) mid-July that ranged from 7% to 13.5%. One company selling traditional LTC announced rate increases (NEW POLICIES) ranging from zero to 49% that take effect September 1st. Insurance companies typically have to file rate changes with States and the process can take a bit of time.

Thus it's not possible to directly say the increases are the result of Covid-19. But it's an educated opinion that they are likely

due to the historic low interest rate environment that has only been made worse by Covid-19's impact on the U.S. economy.

And, because of the Covid-19 economic implications, it's highly unlikely we'll see interest rates go up for some time.

WHY INTEREST RATES AFFECT LONG-TERM CARE INSURANCE PRICING? Insurance companies depend on two sources of revenue to pay anticipated long-term care claims. PREMIUMS paid by policy holders and INVESTMENT RETURN earned on those premiums. Investment return is generally from interest-paying instruments. Because of Covid-19, investment professionals expect the Federal Reserve will keep interest rates low for some time. That's why premiums (costs or rates you pay) for

long-term care insurance are generally being raised. EVERY COMPANY ACTS DIFFERENTLY! Which is why it is important to work with someone who can compare multiple top carriers. Here's proof (including one where current rates are LOWER):

Click on the links below to 'jump' to particular topic.

Some of the major insurers are raising rates (policy costs).

Male, age 54 FL: Lifetime benefit of $3,600-per-month: Policy Cost 2019: $3,645/year. TODAY: $3,311!

WHAT CAN YOU DO NOW? Not all insurers have raised their rates (yet). A good long-term care insurance specialist can compare and help you lock-in current rates.

DISCOUNT CHANGES: Discounts can help couples significantly reduce the cost when both spouses (or partners) apply for long-term care insurance. One leading insurer just announced the 'Spousal Discount" will be reduced from 30% to 15%.

BENEFIT CHANGES: Having a long-term care insurance that pays a "cash" benefit (as opposed to one that just "reimburses" qualifying expenses can be beneficial. A leading insurer just announced cash payments (currently up to 40%) would be reduced to 25% and would be capped.

WHAT CAN YOU DO NOW? You only buy long-term care insurance once - so you really need to do it correctly.

A knowledgeable specialist can help you compare the benefits that suit your needs and make sure you get all the possible discounts you qualify for.

AGES CAPPED: Covid-19 has definitely impacted the ability of older individuals to apply for and secure long-term care insurance.

For example, one major LTC insurance company will not accept an application from anyone over 64. Maximum age for new applicants currently varies by State (and is subject to regular change beased on Covid-19 restrictions on health assessments). Companies that offer "linked benefit" (Life+LTC) policies are asking people over 70 to pay with single premiums. So, instead of paying $8,000 a year, they might have to write a single check for $100,000.

WHAT CAN YOU DO NOW? Long-term care insurance prices, benefits and lots more can vary by state.

40,000 NURSING HOME RESIDENTS DEAD: Covid-19 has definitely impacted the nursing home industry. From the devastating number of residents who have died to the growing risk of bankruptcy facing so many of the nation's skilled nuring facilities.

LTC INSURANCE IS REALLY NURSING HOME "AVOIDANCE" INSURANCE: Most people associate long-term care insurance with a nursing home stay. But MOST LONG-TERM CARE INSURANCE PAYS FOR CARE IN THE POLICYHOLDER'S HOME. In fact more than two-thirds of the $10 billion paid out in long-term care benefits are paid for home care. Covid-19 will very likely increase that percentage.

LTC INSURANCE CAN PAY FOR CARE IN YOUR OWN HOME: But here's where the 'small print' in the policy contract becomes so important. All long-term care insurance policies are contractually ruled by the policy language. One long-term care insurance policy can make you wait 90 days until your care at home is covered. Another will pay immediately (referred to as a Zero Day Deductible or Elimination Period) provision.

IN SOME STATES A "HOME CARE ONLY" POLICY MAY BE YOUR BETTER OPTION: It could be cheaper. It could be easier to apply for. But these policies are NOT AVAILABLE IN ALL STATES and generally it takes an insurance professional proficient in both long-term care and 'short-term care' or 'home care only' policies who can compare for you and explain the important contractual differences.

WHAT CAN YOU DO NOW? Find a specialist for your state who really understands home care options!

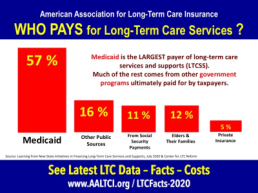

GOVERNMENT CURRENTLY PAYS FOR MOST LONG-TERM CARE (But you MUST be poor to qualify for Medicaid benefits!): Medicaid is the largest payer of long-term care. And due to Covid-19 and the poor economy, millions of Americans are now poor and eligible for Medicaid benefits.

HOW MUCH WILL TOMORROW'S TAXPAYERS BE WILLING TO PAY? That's really the question you have to ask. We all want GREAT BENEFITS ... and WE'D LIKE THEM FOR FREE. But at some point, someone has to pay the bill.

IF YOU ARE "POOR": When you need long-term care, your options will be to turn to loved ones, family members and whatever government programs are available at the time.

IF YOU ARE "NOT" POOR: Which we'd generally say means you have savings and assets of at least $400,000 or $500,000 and more (outside of your home) then you really should consider some long-term care planning. Insurance may be a part of that.

IF YOU EXPECT GOVERNMENT PROGRAMS WILL BE AVAILABLE WITH LOTS OF FUNDS FOR YOU WHEN YOU REACH YOUR 80s or 90s: then you should cross your fingers and hope for the best. I tell my children in their 30s that I hope Social Security will be around when they reach retirement age. But I make sure they contribute to a 401k just in case. HAVING SOME LONG-TERM CARE INSURANCE IN PLACE is like having a 401k to augment social security.

WHAT CAN YOU DO NOW? Find a specialist for your state who will educate you regarding your options and costs for LTC insurance.

Whether you are considering a traditional LTC policy or a 'linked-benefit' (Life+LTC) policy, there can be significant differences in coverage and pricing. To understand the differences, it pays to work with a knowledgeable "specialist" who can compare multiple policies and help you get the best coverage for the best price.

To Speak With a LTC Insurance Specialist

Call the American Association for Long-Term Care Insurance

818-597-3227

There is NO COST and NO OBLIGATION to buy from them.