1035 Exchange Consumer Information Center

Do you currently have an annuity … your "Just in Case" retirement money?

Do you have a cash value life insurance policy you no longer really need?

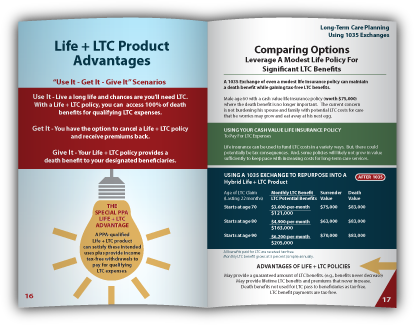

Congress wants more Americans to plan for both retirement and the real risk of needing costly long-term care. The law now permits "1035 Exchanges" of annuities and certain life insurance policies. You may be able to benefit from some significant retirement planning and tax-reduction advantages.

The American Association for Long-Term Care Insurance created a consumer guide explaining ways to "repurpose" your annuity or life policy. We invite you to read the guide now.

The 24-Page Guide Explains

- What Congress & IRS approved.

- How 1035 exchanges work.

- Can they benefit you?

- How to get more tax-advantaged long-term care benefits from your current annuity.

- A way to get 50 months of tax-free long-term care benefit payments from a life insurance policy.

Fast Facts - E-Z to Read

Real Examples In Plain English

Insurance Agent?

Learn More About Educating Your Clients & Offering 1035 Exchange Solutions.