A number of leading insurers now offer coverage that is often referred to as "Short-Term Care". The American Association for Long-Term Care Insurance established the National Advisory Center to help create heightened awareness of this valuable planning option.

If you would like to speak with a short-term care insurance specialist, call the Association at 818-597-3227. Between 9am and 3pm Pacific Time. Or Email your request to us. Your information will be shared with ONLY ONE specialist.

What Is Short-Term Care Insurance

The typical Short-Term Care insurance (STCi) policy provides coverage for 1 year or less. For many people, this is a very appropriate and affordable amount of coverage. It is true that some long-term care claims last for many years,however, almost half (49%) of long-term care insurance claims LAST ONE YEAR OR LESS.

The majority of short-term care insurance policies have a 0-day deductible (Elimination Period) option and a full year of benefits. Simply, that means the policy pays on the very first day that you qualify for benefits. Most traditional long-term care insurance policies (about 94%) are sold with a 90-Day Deductible that must be met before benefits are paid.

It is important to know that these policies can pay in addition to Medicare -- something a traditional Long-Term Care Insurance policy is prohibited from doing.

Most Short-Term Care applications have only 7-to-10 health questions. If you can answer "NO" to all the questions, you are 95% through the health underwriting process.

There are policies that have ONLY 2 "YES" "NO" HEALTH-RELATED QUESTIONS and can be ideal for people with existing health problems.

Who Should Consider A Short-Term Care Policy?

- You (or a spouse) were DECLINED for traditional LTC Insurance.

- You want a LESS EXPENSIVE option (than traditional long-term care insurance).

- You WAITED TOO LONG to buy long-term care insurance (cost is now too high!).

- HOME CARE COVERAGE is more important to you than nursing home coverage.

- You are AGE 75 OR OLDER.

- You are a SINGLE WOMAN (rates for Short-Term Care policies are NOT GENDER-BASED as they are with traditional long-term care insurance).

- You have a long term care insurance policy and you want to cover the Elimination Period.

The typical person buying short-term care insurance is between the ages of 65 and 74 and has a net worth of less than $500,000.

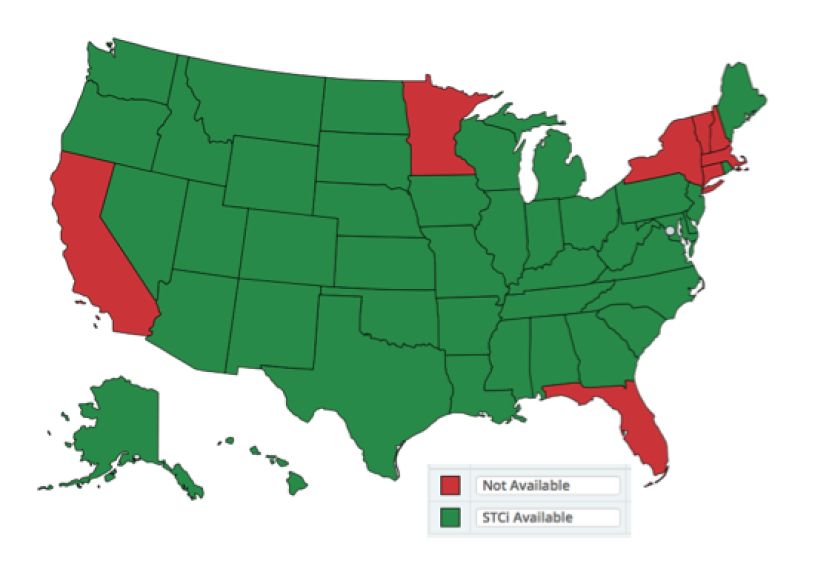

States Where Short-Term Care Insurance Policies ARE Available

Short-term care insurance is NOT AVAILABLE IN ALL STATES. The map below shows states where policies are available (updated as of January 2022).

How Much Does Short-Term Care Insurance Cost?

Policy costs are based on your age and the benefits you select. But this will give you a general idea of what you can expect to pay for 1-year of coverage in benefits. (Updated January 2022)

-

Age 65 - HOME CARE ONLY - BENEFIT OF $1,050-per-week x 52 Weeks

- Female -- $63 monthly .

- Male -- $63 monthly .

Age 65 - HOME CARE - BENEFIT OF $1,050-per-week x 52 Weeks

NURSING HOME BENEFIT OF $200-per-day for 365 Days, 100-Day Elimination Period

- Female -- $125 monthly .

- Male -- $125 monthly .

Age 75 - HOME CARE ONLY - BENEFIT OF $1,050-per-week x 52 Weeks

- Female -- $135 monthly .

- Male -- $135 monthly .

Age 75 - HOME CARE - BENEFIT OF $1,050-per-week x 52 Weeks

NURSING HOME BENEFIT OF $200-per-day for 365 Days, 100-Day Elimination Period

- Female -- $280 monthly .

- Male -- $280 monthly .

Rates subject to change. Illustration for real individual, state of Illinois. Sample from leading insurer. ONLY a licensed agent can give you actual rates.

How To Get A Short-Term Care Insurance Cost Comparison

Call the American Association for Long-Term Care Insurance at 818-597-3227.

Or, if you prefer, click This link to request information. There is no-obligation or cost.

A Few Short-Term Care Facts?

- Minimum Applicant Age: 40 or 50.

- Maximum Applicant Age 85 - 89.

- Typical Benefit Amount $100, $150 or $200 per-day.

- Can a policy pay for Home Care? YES! .

- Can a policy pay for Assisted Living? YES! .

- Can a policy pay for Nursing Home Care? YES! .

Valuable Resources for Consumers

2022 Long-Term Care Insurance statistics

LEARN MORE

Request No-Obligation

Information & Costs

Call: 818-597-3227

Email Your Request.

CONSUMER INFORMATION

STATE DIRECTORY

Click To See Where STC Policies Are Available

CAN YOU HEALTH QUALIFY?

A E-Z Health Overview for STC