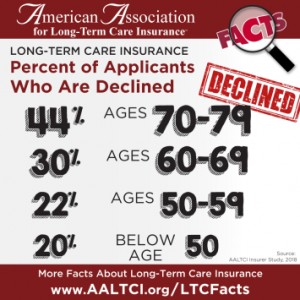

Nearly half of individuals 70 or older who apply for long-term care insurance are declined coverage due to existing health conditions according to a just-released study conducted by the American Association for Long-Term Care Insurance.

“Individuals mistakenly believe they can obtain long-term care insurance protection at any age,” explains Jesse Slome, director of AALTCI. “It is especially harder to health-qualify at older ages because our health changes and it rarely gets better as we age.”

The Association just released results of a study of leading long-term care insurance companies. According to the findings, some 44 percent of individuals age 70 or older who applied for coverage were declined. “That means they took the time to work with an insurance agents who completed and submitted an application,” Slome notes. “When health conditions already exist the agent will typically advise the individual they will be declined and not spend time completing the application.”

At younger ages the percentage of individuals declined for traditional long-term care insurance policies is lower but still significant reports AALTCI. “This year’s study found the percentage of declined applicants increased compared to the similar study conducted a few years ago.

“The decline rate for individuals between ages 50 and 59 was 22 percent in 2017 compared to our 2014 buyer study when the decline rate was 17 percent,” Slome notes. The decline rate for applicants below age 50 was 20 percent in 2017 compared to 12 percent in 2014.

“So many Americans take medications which mislead us to think we are in good health when we really are in good controlled health,” Slome adds. “It’s advisable to start thinking about long-term care planning in your 50s,” he advises. “That’s when costs are lower and, more important, you are far more likely to meet the required health qualifications. Once your application is accepted your coverage can not be cancelled even when your health changes, and it will change.”

To learn more about long-term care insurance costs and planning options call the American Association for Long-Term Care Insurance at 818-597-3227 or visit the organization’s website at www.aaltci.org to find and connect with local LTC insurance professionals.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!