Insurance companies are regulated and monitored by each state's Department of Insurance (DOI). One of the DOI's primary objectives is protecting policyholders from the risk of an insurance company in financial distress. So, what happens if (when) an insurer enters a period of financial difficulty and is unable to meet its obligations? The answer: the insurance commissioner in the company’s home state initiates a process—dictated by the laws of the state. Efforts are made to help the company regain its financial footing. This period is known as rehabilitation.

If it is determined that the company cannot be rehabilitated, then the company is declared insolvent. At that point the insurance commissioner will ask the state court to order the liquidation of the company.

In every state, the life and health insurance "Guaranty Association" exists. These are state entities (also in Puerto Rico and the District of Columbia) created to protect policyholders should an insurance company become insolvent.

WHO PAYS? All insurance companies (with limited exceptions) that are licensed to sell life or health insurance in a state must be members of that state’s guaranty association. They will ultimately pay for the consumers' protection.

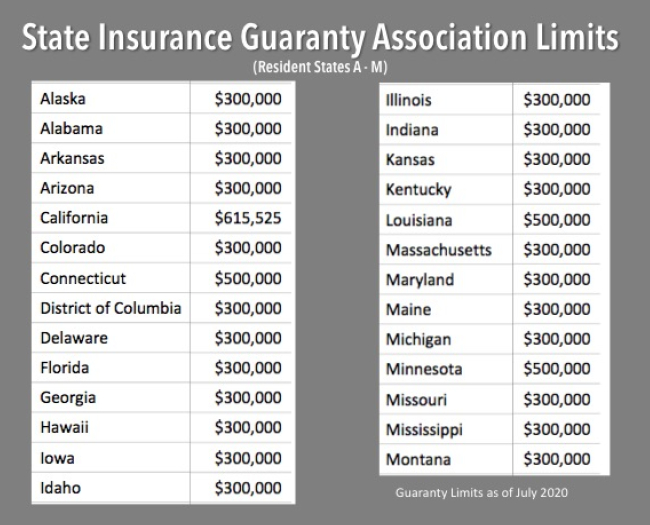

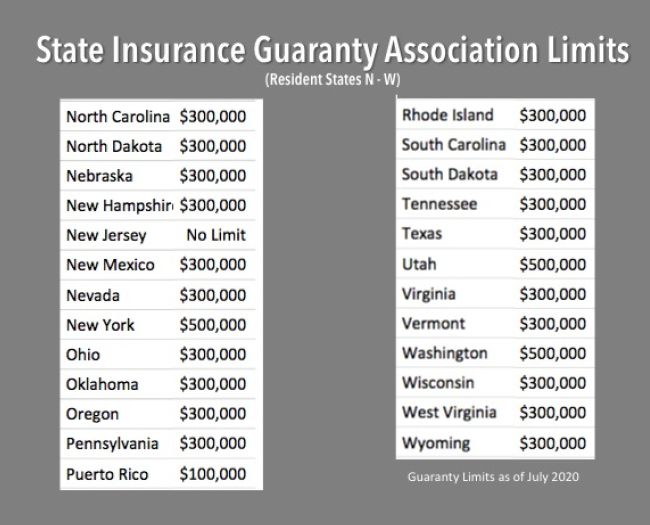

Once the liquidation is ordered, the guaranty association provides coverage to the company’s policyholders who are state residents (up to the levels specified by state laws—see below.

IMPORTANT POINT: Any benefit amounts above the guaranty asociation benefit levels become claims against the company's remaining assets. For long-term care insurance policy, many older policies may have benefits that exceed the level and thus will not be included under the guaranty level. A consumer would have to adjust (down) coverage prior to an insurer declaring insolvency. That said, the Association does not (can not) provide legal advice in this area. Check with your attorney should this be a concvern.

WHO IS COVERED> When an insurance company that is a member of the guaranty associations fails here's what happens. The policyholders are generally covered by the guaranty associations in the state where the policyholder(s) reside. Depending on the type of insurance contract (life, health, long-term care insurance) the guaranty associations typically provides coverage to the owner of a policy. The same generally applies to group certificates.

WHAT ABOUT MY CAR OR HOME INSURANCE? A separate set of state guaranty associations provides protection for what's referred to as property and casualty insurance (car, home owners, rental, etc.). Policyholders can contact the National Conference of Insurance Guaranty Funds with questions about this type of coverage.

State Guaranty Association Levels - Based on Resident State

Make comparing long-term care insurance easy.

To understand the differences between policy options and get cost quotes, it pays to work with a knowledgeable "specialist" who can compare multiple policies and help you get the best coverage for the best price.

To Speak With a Long-Term Care Insurance Specialist

Call the American Association for Long-Term Care Insurance

818-597-3227

Click Here to E-mail The Association. We'll Connect With ONE LTC Specialist

There is NO COST and NO OBLIGATION to buy from them.

Valuable Links for More State Guaranty Association Information

State Departments of Insurance and Guaranty Information - you can also do a Google search for (Name of State) Department of Insurance

National Organization of Life and Health Insurance Guaranty Associations

Link to National Organization of Life and Health Insurance Guaranty Associations

Helpful Links for Consumers

Medicare insurance agents - Visit our sister organization, the American Association for Medicare supplement to use the free online directory of Medicare insurance agents.